Forex trading, or foreign exchange trading, allows investors to speculate on the price movements of currency pairs. A fundamental concept within this domain is the term “pip.” This article will explore what pips are, their significance in trading, how they can impact your strategy, and practical tips for mastering their use.

Understanding Pips: The Building Blocks of Forex Trading

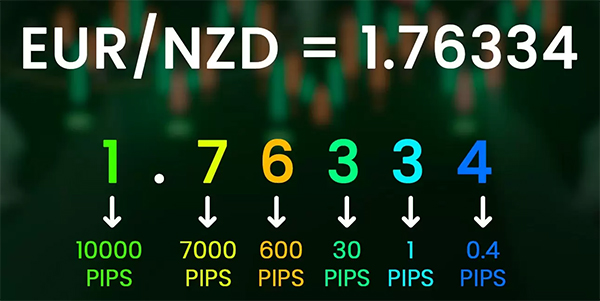

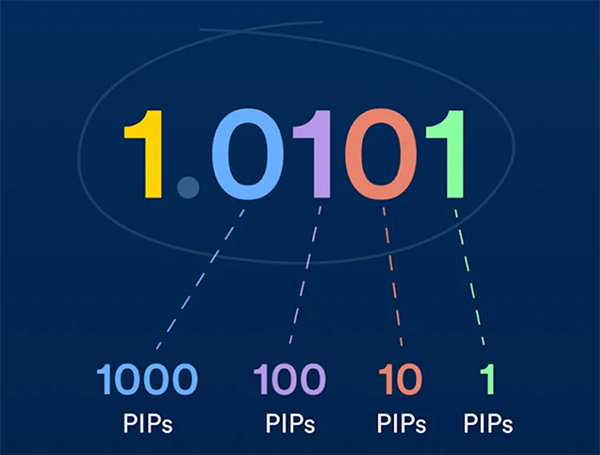

In forex terminology, a pip is short for “percentage in point” or “price interest point.” It represents the smallest price move that a given exchange rate can make, based on market convention.

Key Characteristics of a Pip:

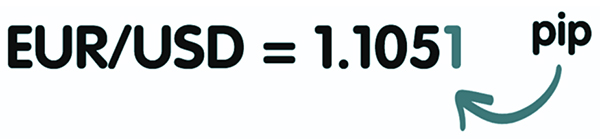

- Standard Measurement: A pip typically denotes the fourth decimal place in most currency pairs (e.g., 1.2345).

- Exceptions: For currency pairs involving the Japanese Yen, a pip is the second decimal place (e.g., 110.25).

- Value Fluctuation: The monetary value of a pip can vary depending on the size of your trade (lot size).

The Definition of a Pip and Its Role in Currency Markets

Pips serve as the standardized unit of measurement in currency trading. They help traders quantify price movements and assess potential gains or losses. Understanding pips is crucial for calculating the potential profit or loss from a trade, making them a vital component of forex trading strategies.

Example:

If a trader buys EUR/USD at 1.1300 and sells it at 1.1320, they have gained 20 pips. If each pip is worth $10 (depending on the lot size), the trader’s profit would be $200.

How Pips Affect Your Forex Trading Strategy and Profits

Understanding how to effectively use pips can help traders craft robust trading strategies and manage risk. Here are a few ways pips influence trading:

- Profit Calculation: Pips directly impact the total profits or losses from trades.

- Risk Management: Traders often set stop-loss and take-profit levels based on pip values.

- Trade Size: The value of a pip can change with different trade sizes, necessitating an understanding of lot sizes for effective capital management.

Practical Tips:

- Always Calculate Pip Value: Use a pip calculator to understand how much each pip is worth in your base currency.

- Set Realistic Targets: When setting profit goals, consider average pip movements for the currency pair being traded.

- Use Pips for Risk Assessment: Determine your maximum acceptable loss in pips to manage risk effectively.

Calculating Pips: A Simple Guide for Forex Traders

Calculating pips can be straightforward with a bit of practice. Here’s a quick guide to understanding pip value based on different lot sizes:

| Lot Size | Pip Value (in USD) | Calculation Method |

|---|---|---|

| Standard Lot | $10 | 1 pip = $10 (10,000 units) |

| Mini Lot | $1 | 1 pip = $1 (1,000 units) |

| Micro Lot | $0.10 | 1 pip = $0.10 (100 units) |

Example Calculation for a Standard Lot:

- If you are trading a currency pair where 1 pip = $10 and you close your trade with a profit of 30 pips, your profit will be:

[

30 text{ pips} times $10/text{pip} = $300

]

Common Misconceptions About Pips in Forex Trading

Despite their importance, several misconceptions about pips can mislead novice traders:

- Pips Are Always the Same Value: The value of a pip can change based on the currency pair and lot size.

- Pips Only Matter for Long-Term Traders: Short-term traders (scalpers) also need to understand pip value for executing quick trades effectively.

- Pip Value is Constant: The monetary value of a pip can vary with exchange rates and trade sizes.

Conclusion: Mastering Pips for Successful Forex Trading

Understanding and mastering pips is essential for any forex trader looking to navigate the complexities of the currency markets. By utilizing pips effectively, traders can enhance their strategies, manage risks, and ultimately improve their profitability. Whether you are a novice or an experienced trader, grasping the concept of pips can elevate your trading game.

Frequently Asked Questions (FAQ)

1. What is the difference between a pip and a pipette?

A pipette is a fractional pip, representing one-tenth of a pip. It adds extra precision to price movements, especially in highly liquid markets.

2. How do I calculate my potential profit using pips?

To calculate profit, multiply the number of pips gained by the pip value for your lot size. For example, if you gain 50 pips in a standard lot, your profit would be 50 x $10 = $500.

3. Can pips differ between brokers?

No, pips are standardized across the forex market. However, brokers may have different spreads, which can affect your trading costs.

4. Is it possible to trade without understanding pips?

While it’s technically possible, it is highly inadvisable. Not understanding pips can lead to confusion about profits, losses, and overall risk management.

5. How can I improve my pip trading skills?

Practice consistently on a demo account, utilize trading simulations, and keep a trading journal to analyze your pip-based trading decisions.

6. Do all currency pairs have the same pip value?

No, the pip value can vary based on the currency pair and the lot size traded. Always calculate pip values specific to the currency pair you are trading.

7. Why are pips important in forex trading?

Pips are vital because they provide a standardized way to measure price fluctuations, enabling traders to evaluate their performance and manage risk effectively.

10 Comments

This article explains how to calculate pips clearly. It’s helpful for beginners.

I learned that a pip is really small but important in forex trading.

“I appreciate the tips on setting realistic targets using pips. Very useful!”

“This article clears up a lot about misconceptions around pips. Great read for new traders!”

‘Percentage in point’ makes sense now! Pips are crucial for profit calculation.

Understanding pips is essential! I will use this info to manage my trades better.

“So, I need to keep track of pips for risk management. This is valuable information!”

I didn’t know pips could change value based on lot size. Good to know!

“It’s interesting how different currency pairs use different pip values. Makes trading complex.”

The example of buying and selling with pips was easy to follow. Thanks!